Liquidity Pools in Sports Betting: The Next Frontier of Fair Play

Liquidity pools, inspired by decentralised finance (DeFi), are transforming online sports betting. Traditional bookmakers set odds and margins to guarantee profits, but liquidity pools introduce a model built on transparency, efficiency, and shared value. At BettingRanker, we examine how this user-centric system is reshaping the industry and offering UK bettors a more equitable experience.

What are Liquidity Pools in Sports Betting?

In sports betting, a liquidity pool is a collective pot of funds contributed by numerous users to support wagering markets. Instead of a bookmaker acting as the counterparty for every bet, the pool holds the funds that cover payouts. Users can function as both bettors and liquidity providers (LPs), contributing capital back into the system. Smart contracts automatically manage sports betting odds, settle bets, and enforce rules, significantly reducing the need for human oversight and potential bias.

This concept is adapted from DeFi, where liquidity pools revolutionised token trading by providing constant liquidity without traditional order books. In the betting context, the same advantages apply: real-time odds adjustments, automated settlements, and fully auditable transactions. As more participants contribute to a pool, market volatility decreases and odds become more stable—benefitting both bettors and liquidity providers.

Because the pool is governed by transparent code rather than opaque policies, trust is inherent in the system. By design, bettors can be confident that once they meet the smart contract's requirements, payouts will be automatic and fair.

Comparing Liquidity Pools vs. Traditional Bookmakers

Traditional bookmakers rely on centralised odds-setting and internal risk management. Bookies bear all liabilities and incorporate a house edge to ensure profitability. This model often necessitates manual odds adjustments based on betting activity when betting on sports, exposing it to human bias and delays in reaction.

In contrast, platforms utilising liquidity pools operate via smart contracts that execute automatically based on live data. These platforms decentralise risk among liquidity providers, replacing the house edge with service fees. Automation reduces operational costs, enhances fairness, and eliminates conflicts of interest that arise when an operator profits from user losses.

Traditional Bookmakers vs. Liquidity Pool Platforms in the UK

| Feature | Traditional Bookmakers | Liquidity Pool Platforms |

|---|---|---|

| Odds Control | Centralised (by bookmaker) | Decentralised (via smart contracts) |

| Profit Model | House edge & user losses | Transaction fees |

| Risk Management | Internal hedging | Shared across liquidity providers |

| Transparency | Limited | Full (on-chain visibility) |

| User Role | Bettor only | Bettor + Liquidity Provider |

| Payout Settlement | Manual or delayed | Instant via smart contracts |

Why UK Sports Bettors are Embracing Liquidity Pools?

- Better Returns & Fairer Odds: With no built-in house edge and lower operational costs, liquidity pool models often provide more favourable returns to UK bettors. In some systems, payout improvements of 20–30% over traditional offerings are achievable. Because profits are generated from fee mechanics—not from managing losing bets—the model aligns incentives differently.

- Transparency & Verifiability: Everything—from bet placement to odds changes and settlement—is recorded on-chain. This means bettors can verify that the system adhered to its rules. There’s no hidden adjustment, delayed settlement, or operator interference behind the scenes. The auditability inherent to blockchain significantly boosts trust for all users.

- Participation as Stakeholders: Liquidity pool models blur the lines between bettor and investor. Users can stake capital into the pool and earn fees, effectively giving them a stake in the platform's performance. This dual-role model encourages greater engagement and aligns user interests with platform success.

- Lower Counterparty Risk: In centralised betting, users rely entirely on the solvency and integrity of the bookmaker. In a decentralised pool, however, funds are held in smart contracts under collective control. This shifts greatly reduces the risk of fraud, insolvency, or manipulation by a central operator.

Operator Advantages and Sports Platform Stability

Liquidity pool systems also benefit operators by redistributing risk and improving capital efficiency. Rather than absorbing every bet’s liability, platforms share exposure with liquidity providers. Here are some advantages for operators:

- Shared Risk & Capital Efficiency: Instead of absorbing full liability, operators offload risk to liquidity providers, optimizing how capital is allocated.

- Scalable Growth: As pools grow, the system naturally acquires liquidity without requiring proportional capital injections from the operator.

- New Market Expansion: Deep liquidity supports launching new bet types, longer odds markets, and more exotic wagers with less incremental risk exposure.

- Regulatory and Audit Clarity: Because smart contracts are transparent and traceable, operators can more easily demonstrate compliance, fairness, and anti‑fraud mechanisms to regulators.

Together, these elements allow platforms to expand faster, leaner, and with better systemic robustness.

Technological Innovation and Industry Evolution in Spots Betting

Smart Contracts, Oracles & AMMs

Smart contracts form the backbone of a liquidity pool system, but they require precise event data to function properly. Oracles feed real-world sporting outcomes, statistics, and timings into the blockchain to trigger payouts, validate online payment methods' conditions, and adjust odds. In some DeFi‑betting hybrids, oracles are decentralized or multi-sourced to avoid single points of failure or manipulation.

On the pricing side, liquidity pools often rely on automated market maker (AMM) logic or constant-function market maker (CFMM) models, adapting formulas such as x×y=kx \times y = kx×y=k to define how odds shift relative to pool composition. In sports betting, modified AMM logic (for instance, UBET’s UAMM) has been proposed to better align odds with bookmakers’ models.

AI & Machine Learning Optimization

Artificial intelligence and machine learning overlay new intelligence on top of immutable contract logic. These systems can:

- Anticipate betting flows and adjust liquidity parameters dynamically.

- Predict mismatches or imbalances in pool segments and reallocate capital.

- Detect suspicious betting patterns or arbitrage exploits.

- Aid in managing impermanent loss risk by adjusting fee curves adaptively.

By integrating AI/ML, platforms can enhance odds accuracy and system resilience.

Hybrid Models & Industry Adoption

Some established sportsbooks are exploring hybrid structures—combining centralized control and liquidity pool features. These hybrids might retain traditional odds control while opening select markets to decentralized liquidity. This approach provides familiarity to users and operational safety for legacy platforms.

Indeed, several pioneering operators are already piloting full liquidity pool platforms, showing that the concept is more than theoretical—it’s actively being tested in live environments.

Real-World Examples and Regulatory Landscape in Sports Betting

Major Providers with Liquidity Pool or P2P Potential

Several companies are leading or supporting the shift toward decentralized or pool-based betting:

- Playtech – A major sportsbook and iGaming software vendor with the capability to support liquidity pool architecture.

- Evolution – Known for live casino offerings, Evolution’s platform reach makes it a strong candidate for P2P integration, though it lacks current pool-specific features.

- OpenBet – Supplies high-volume sportsbook systems with architecture that supports multi-market liquidity aggregation.

- Longitude LLC – Specializes in pari-mutuel betting and has pioneered shared liquidity pool mechanics in large-scale betting markets.

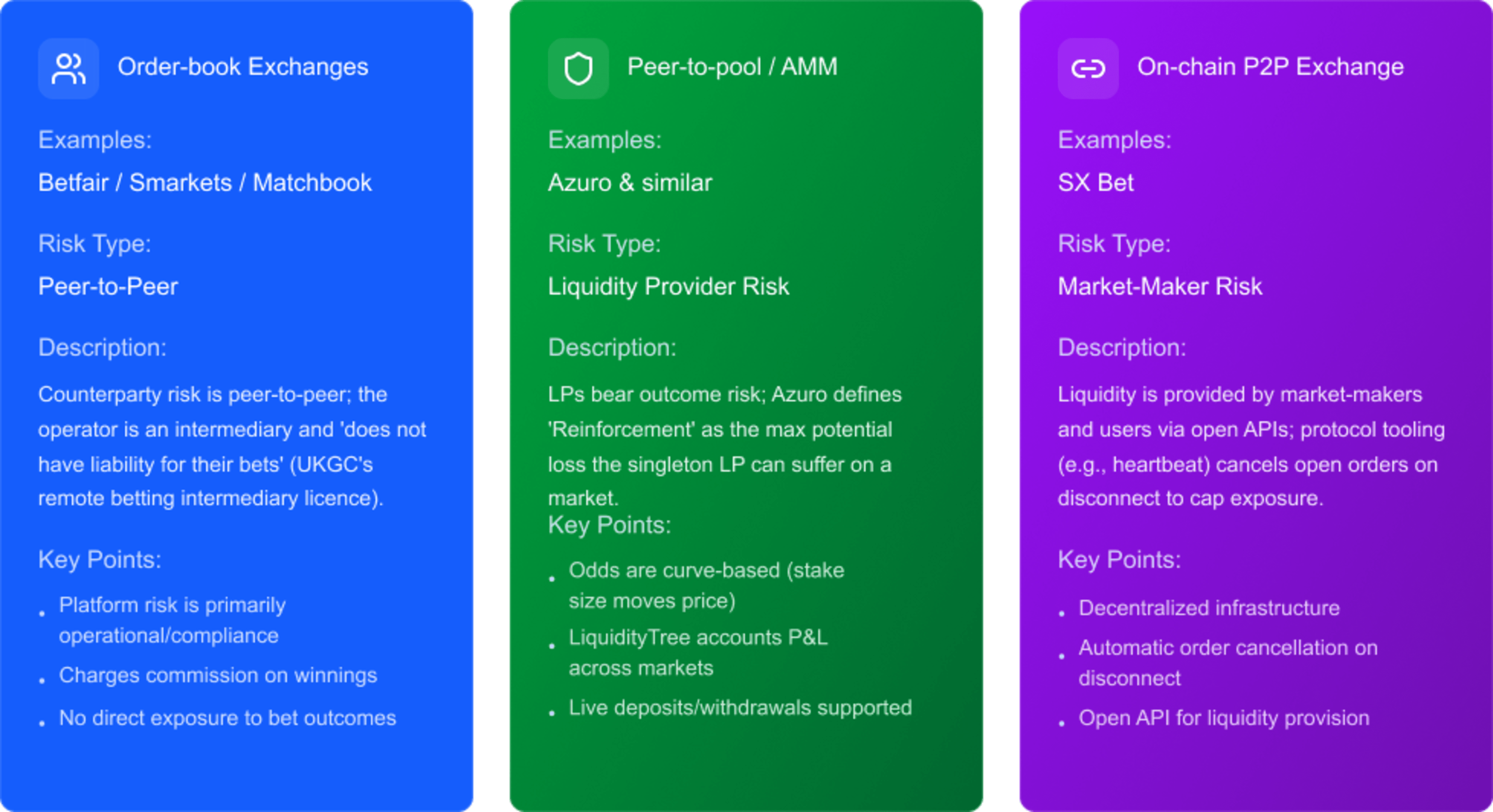

Different Risk Models in Use

The way platforms manage and distribute risk varies depending on the architecture:

- Order-book Exchanges (e.g., Betfair, Smarkets, Matchbook): Counterparty risk is peer-to-peer. The platform acts as an intermediary without taking liability for user bets. Its income is derived from commissions.

- Peer-to-Pool / AMM (e.g., Azuro): LPs bear the risk of outcomes. For instance, Azuro introduces a "Reinforcement" metric to cap the maximum loss an LP can face. Odds shift based on stake size using an algorithmic curve model.

- On-Chain P2P Exchanges (e.g., SX Bet): Liquidity is sourced from both users and market makers through APIs. Systems like "heartbeat" ensure exposure is capped by canceling open orders when users disconnect.

Where Exchange and P2P Betting Is Permitted

Betting regulation varies globally. The following jurisdictions allow exchange or peer-to-peer betting:

| Country | Regulatory Notes |

|---|---|

| United Kingdom | Licensed under the UKGC as remote betting intermediaries; exchanges like Betfair operate legally. |

| Ireland | Requires a Remote Betting Intermediary Licence; subject to Betting Intermediary Duty. |

| Spain | National legislation includes “Apuestas deportivas cruzadas” (exchange sports betting). |

| Australia | The Northern Territory licenses betting exchanges; Betfair Pty Ltd holds this license. |

| United States | Authorized in some states (e.g., New Jersey) for horse racing and sports wagering under state-specific rules. |

These regions provide blueprints for how decentralized or hybrid models can operate legally and competitively. The trend toward expanding these frameworks is likely as technology and user demand evolve.

Risk Managements Frameworks:

Key Benefits of Liquidity Pools in Sports Betting

Here’s a summary of the standout benefits for bettors and top sports betting platforms:

- For Bettors: Higher potential returns, better odds, and full transparency through blockchain verification.

- For Platforms: Risk decentralization, cost reduction, and simplified compliance with regulatory standards.

Conclusion: The Future Is Transparent and Decentralized

Liquidity pools aren’t just disrupting sports betting—they’re redefining it. By removing centralized control, reducing systemic risk, and empowering users through dual participation, they represent a sustainable and scalable model for the future. Top platforms already adopting this model are demonstrating that decentralized betting is not only viable but highly competitive.

As users demand more transparency, fairness, and financial upside, liquidity pools stand out as the logical evolution. Those who embrace this change early—whether operators or bettors—will be best positioned to benefit in the next era of online betting.

FAQ

What is a liquidity pool in sports betting?

A liquidity pool is a shared pot of funds where users contribute to support betting markets. It replaces the traditional bookie with smart contracts that automatically handle odds, payouts, and bet settlements.

How does liquidity pool betting differ from traditional sportsbooks in the UK?

Unlike traditional sportsbooks that control odds and profit margins, liquidity pools use algorithms driven by market activity. Users participate directly by placing bets or providing liquidity, making the system more transparent and potentially fairer.

Are liquidity pools legal for online betting in the UK?

The legality of liquidity pools depends on UK gambling regulations. Their transparent and blockchain-based nature can make demonstrating regulatory compliance easier. Always check the licensing and regulatory status of any platform before participating.

Do liquidity pools offer better odds than traditional bookmakers?

Yes, liquidity pools can offer better odds due to lower operational costs and the absence of a significant house edge. Odds are adjusted in real-time based on market activity, potentially offering more competitive prices.

Can users earn by providing liquidity to these pools?

Yes. Users who contribute to the pool earn a share of transaction fees and may also profit from successful bets. This creates a dual-income opportunity not typically available in traditional betting models. Remember to gamble responsibly.

How do smart contracts manage sports bets in liquidity pools?

Smart contracts automatically adjust odds, accept wagers, settle bets, and distribute winnings. This eliminates manual intervention, reducing the risk of human error and ensuring faster, more reliable outcomes.

How secure is liquidity pool betting?

Liquidity pool platforms use blockchain technology and smart contracts, which reduce counterparty risk and increase transaction transparency. Funds are managed autonomously, not by a single centralised entity, enhancing security.

What are the advantages of liquidity pools for betting operators in the UK market?

Operators benefit from distributed risk, automated operations, and lower overhead. As the pool grows, market stability improves without increasing liability. This can lead to more sustainable and efficient betting platforms.

Are traditional sportsbooks likely to adopt liquidity pool models?

Yes, hybrid models are emerging as sportsbooks explore decentralised features. Integrating liquidity elements helps them remain competitive and user-focused in a rapidly evolving market. This could lead to innovative betting experiences for UK punters.